Manney ‘the’ Felix

Today, May 1, would have been my dad’s 105th birthday. The Felix family was fortunate to have had him with us for 92 years. You may wonder what ‘the’ represents in his name: he wasn’t given a middle name and many years ago we started calling him that…he loved it. Thinking of you dad!

Investor Relations Forum

A couple of weeks ago I chaired the Investor Relations, Marketing & Communications Forum in NYC run by PEI (Private Equity International). It was a very interesting and new type of experience in my history of chairing ‘industry’ events. Of the 240 attendees I hardly knew anyone (great networking opportunity). They were professionals from the broad Private Equity industry. There were no LP’s in attendance. The special thing was the transparency exhibited from the moderators and panelists about their challenges.

One topic that got considerable attention was the Annual Investor Conference / AGM (Annual General Meeting). My partner Liz Weiner and I conducted a ‘Master Class’ called: The Annual Investor Conference: Powerful ways to engage and update with your investors.

The brainstorming part of the class was fascinating and the discussion totally open – people sharing their experiences, what’s going well, what’s not going well and what they could do differently next time – The Power of the Debrief that Liz and I both use ourselves and encourage all our clients to use (Here’s a link where you can download our article on The Power of the Debrief.

Racine (Wisconsin) Art Museum

Friday I took the Amtrak train up to Racine from Chicago, just a few minutes over an hour. It was a very nice day, and it was the first time in quite a while that I had seen ‘rural America’ – farms, horses, cows. Spending most of my time in New York I had forgotten how peaceful that type of scenery is.

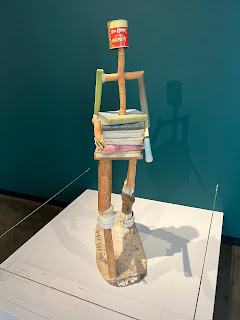

A friend from Racine took me to the Racine Art Museum. Never having sought out ‘contemporary crafts’ before I was blown away by the exhibit. As the adage says, ‘A picture is worth a thousand words’ I’ve included a few photos from the museum. If you live in the area and haven’t been to the museum, I encourage you to visit it and if you’re going to be in Chicago on business, it’s a short train ride and just over an hour by car.

Final thing:

I’ve been working on a memoir for a number of years. It’ll just be for my family. I have a spreadsheet of topics I want to write something about – all the places I’ve lived, all the jobs I’ve had, all the concerts I’ve attended and the bands I’ve played in – you get the picture.

One thing that has come out of it already is that as I’ve remembered and written about certain memories and experiences I’ve reached out and connected with a few folks that I haven’t been in touch with in a gazillion years – thanks to the Internet.

I had dinner with the bass player in the first rock and roll band I played in called ‘The Better Half.’ I had a long conversation with a star baseball player from our team at Fairleigh Dickinson University. I’m scheduled to talk with an architect, a student of Frank Lloyd Wright’s who was working for the Kohler Co. (Kohler, Wisconsin) at the same time that I was a real estate consultant there. He and I became friends and he helped me navigate the politics that came with that territory.

I mention this because our lives are about the people we’ve met and the experiences we’ve had. So, maybe there are some folks that you haven’t seen or spoken to in ages that you want to reach out to now because, as with the title of my 4th album of original songs that I’m starting to record in Asheville, NC in a couple of weeks: You Never Know!